China has announced it will loosen its monetary policy to boost the economy, in a move that echoes steps taken in 2009 in the wake of the financial crisis.

The People’s Bank of China, the country’s central bank, will use a slew of different policy tools to boost the money supply — a move often criticized as “printing money” — including government debt and changes to interest rates and the amount of reserves it requires banks to hold.

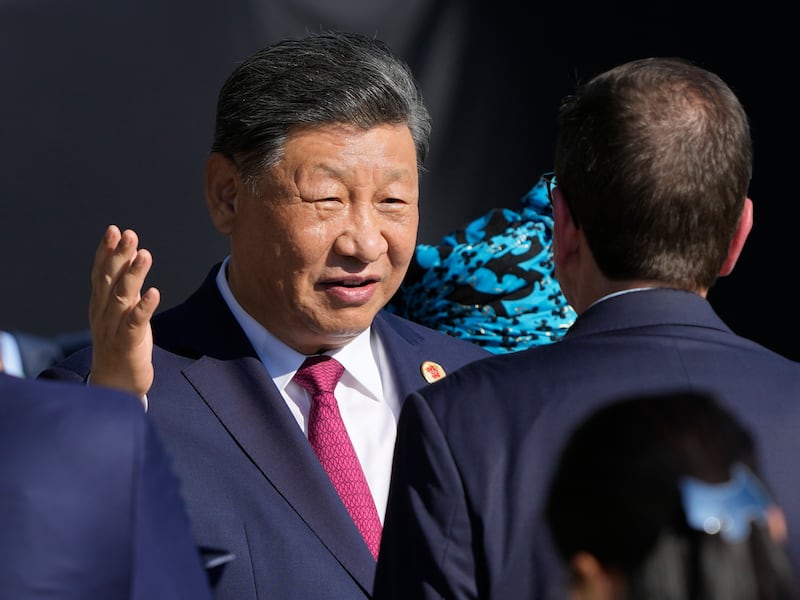

The ruling Chinese Communist Party’s Politburo announced the move on Tuesday following a top-level economic meeting on Monday, state news agency Xinhua reported.

“After more than 10 years, the monetary policy orientation has been changed to ‘moderately loose’ again ... sending a positive signal that will effectively boost the confidence of all parties and help China’s economy recover and improve,” it quoted the meeting as saying.

It said “moderately loose” means a “reasonable money supply, low interest rates, and a relatively loose monetary and credit environment” to boost investment and consumption.

What is the point of the policy change?

According to the Politburo, the aim is to “maintain a reasonable abundance of liquidity, reduce the comprehensive financing costs of enterprises and residents, and provide financial support for the continued recovery of the economy.”

In other words, the central bank will make it easier for institutions and individuals to borrow money, increasing the amount of money in the system and, if successful, business confidence along with it.

Lack of confidence in China’s economic future, particularly after the three-year zero-COVID policy emptied local government coffers and burst the property bubble, has been frequently cited as the main reason behind a mass exodus of people and companies.

Experts say the move is also a bid to forestall the impact of 60% tariffs on Chinese goods that president-elect Donald Trump has vowed to impose on taking office.

Party leader Xi Jinping has also signaled that he wants to shift China’s economy away from its dependence on exports by boosting domestic consumption.

But economists have warned that the government’s growth figures don’t represent the true scale of damage done to the economy, and to confidence generally.

RELATED STORIES

Trump vows an additional 10% tariff on Chinese goods

Chinese markets in turmoil amid stimulus hopes

China deletes warning that youth unemployment is tanking economy

How will it work in practice?

The government has also said it will combine a looser monetary policy with a “more active” fiscal stance.

That means boosting government spending, particularly on infrastructure projects, a path that has been taken by Xi’s predecessors in response to external shocks.

“More active fiscal policy usually means more active fiscal expenditure, with the government vigorously building bridges and roads to support economic construction and improve people’s lives,” state-run China Radio International’s Voice of China said in a commentary published on Wednesday.

“Under the premise that the government’s fiscal revenue is basically stable, the essence of a more active fiscal policy is actually to increase the fiscal deficit rate, issue more treasury bonds, and expand fiscal spending,” it said.

Wasn’t everyone expecting this to happen in September?

Chinese stock markets have surged and fallen on hopes of a massive fiscal stimulus package that was initially expected in September, and then again after subsequent high-level economic meetings in recent months.

The central bank did cut some interest rates and the government started selling ultra-long bonds as part of a massive 1 trillion yuan (US$138 billion) package.

But the measures were nowhere near the levels that markets had been hoping for, with many commentators speculating about a possible fiscal stimulus package along the lines of the one launched by former President Hu Jintao and his Premier Wen Jiabao that kickstarted the Chinese economy in the wake of the 2008 financial crisis.

U.S.-based economic commentator Zheng Xuguang said the latest policy change could be much closer to that package.

“This approach means that the central government will rescue the markets and local governments, and stimulate investment and consumption using this active fiscal and looser monetary policy,” Zheng told RFA Mandarin in a recent interview.

How did this turn out in the past?

Wen is credited with pumping new life into the economy with a massive stimulus program worth 4 trillion yuan (US$586 billion).

But critics say the Hu administration’s approach is at least partly responsible for the massive increase in government debt, rampant inflation and the now-collapsed property bubble that China faces today.

According to Zheng Xuguang, this is akin to “quenching one’s thirst with poison.”

“All the central government can do is take action to rescue real estate prices and ease local debts, which could be very damaging in the form of inflation,” he said.

Xie Tian, a professor at the Aiken School of Business at the University of South Carolina, said the move means Beijing has abandoned its formerly conservative approach to printing money.

“The only option they have left is to continue printing money at great risk, including the risk of losing power. There is really no other way forward,” he said.

Translated and edited by Luisetta Mudie.